- Home

- Views On News

- Jan 10, 2024 - This Undiscovered Smallcap Stock is Set to Benefit from the Ram Mandir Opening

This Undiscovered Smallcap Stock is Set to Benefit from the Ram Mandir Opening

While green energy, electric vehicles and semiconductors are long-term investing themes, a new short term emerging theme has been the hot topic in January 2024.

Short-term investing themes are like one-off cases where a certain event creates a buzz for that topic and companies involved in that space see a significant jump for a short time.

Like the cricket world cup 2023, we discussed how this global event scheduled in India created investing opportunities in certain stocks like hotel, airlines, etc.

Similarly, in January 2024, the keyword has been Ram Mandir and the opening of this mega temple in Ayodhya.

Millions of Hindus spread all over the world are expected to visit Ayodhya this month as the Ram Mandir gets inaugurated on 22 January 2024.

According to reports, government authorities are expecting the daily footfalls in the city to go up to 300,000.

While the tourism industry is already ripe for disruption, the third quarter is especially good for them as many people plan their holidays around the winter season in the country.

Anyway coming back to the stock in discussion for this article...

Shares of NSE listed Apollo Sindoori Hotels are expected to be in demand until the inauguration.

Here's why...

Undiscovered Smallcap that can Benefit from Ram Mandir Opening

Apollo Sindoori Hotels is engaged in the business of managing food outlets at hospitals and reputed organisations.

The company also undertakes outdoor catering services, skilled manpower to hospitals, among other things.

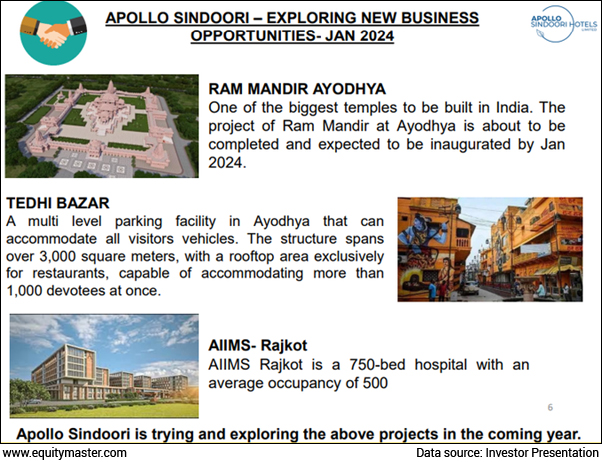

The company has a multi-level parking facility in Ayodhya spanning 3,000 square meters.

It also includes a rooftop area for restaurants which can host multiple devotees simultaneously. So, you can see how the company stands to benefit and how it can see a one-time spike in revenue in the remaining two quarters of FY24.

The development of this multi-level parking facility in Ayodhya called as Tedhi Bazar was notified sometime last year when the Ram Mandir topic was yet to be discovered by the investing world.

The company is currently also exploring options to build a hospital in Rajkot, along with other business projects.

A Close Look at the Financials and Growth Plans

In FY23, the company saw a sharp spike in its revenue to Rs 3.6 billion (bn) compared to Rs 2.1 bn in FY22.

Net profit came in at Rs 169 million (m) compared to Rs 148 m in FY22.

Financial Snapshot

| Rs m, consolidated | FY19 | FY20 | FY21 | FY22 | FY23 |

|---|---|---|---|---|---|

| Net Sales | 1,654 | 1,935 | 1,687 | 2,079 | 3,670 |

| Growth (%) | 18% | 17% | -13% | 23% | 76% |

| Operating Profit | 142 | 135 | 86 | 146 | 259 |

| OPM (%) | 9% | 7% | 5% | 7% | 7% |

| Net Profit | 206 | 153 | 96 | 148 | 169 |

| Net Margin (%) | 12% | 8% | 6% | 7% | 5% |

| ROE (%) | 16.2 | 7.7 | 11.4 | 15.6 | 15.2 |

| ROCE (%) | 22.7 | 13.4 | 14.1 | 19.6 | 18.5 |

| Dividend (Rs) | 3.0 | 2.0 | 1.3 | 1.5 | 1.5 |

| Debt to Equity (x) | 0.0 | 0.1 | 0.1 | 0.1 | 0.9 |

For the September 2023 quarter, the company posted a net profit of Rs 18 m compared to 38 m in the June 2023 quarter and 35 m in the year ago period.

It highlighted in its investor presentation that raw materials prices like jeera, dhaniya powder, chilli powder, basmathi rice, flour, and curd have increased on an average of 20-25% and LPG by 8% in the year gone by.

It also mentioned that input cost pressure that it faced due to increase in raw material prices is temporary and should cool off soon.

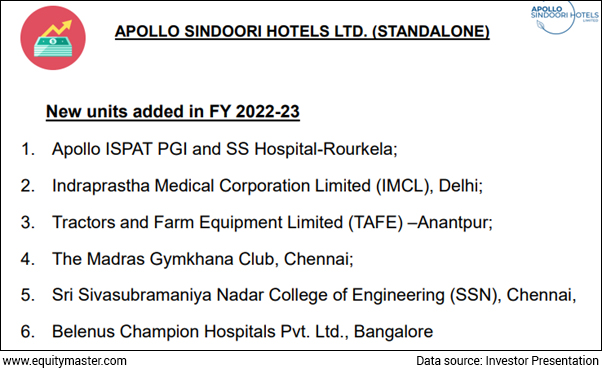

The company has added these new units in FY23.

Apart from this, it has strong growth prospects and has planned for a massive capex.

How Apollo Sindoori Hotels Share Price has Performed Recently

Apollo Sindoori Hotels share price spiked up to 15% today to hit an all-time high.

In the past five days, shares of the company have shot up almost 50%.

While in the past one year, shares of the company have gained over 75%.

Apollo Sindoori has a 52-week high of Rs 2,295 touched today and a 52-week low of Rs 1,020 touched on 28 February 2023.

Here's a table comparing Apollo Sindoori with its peers.

Comparative Analysis

| Company | Apollo Sindoori | Ind Tourism Dev | Oriental Hotels | Samhi Hotels |

|---|---|---|---|---|

| ROE (%) | 15.2 | 18.8 | 11.3 | 0.0 |

| ROCE (%) | 18.5 | 27.3 | 14.1 | 9.6 |

| Latest EPS (Rs) | 60.6 | 8.5 | 2.7 | -15.5 |

| TTM PE (x) | 32.9 | 53.8 | 45.9 | - |

| TTM Price to book (x) | 4.1 | 10.9 | 4.1 | 3.6 |

| Dividend yield (%) | 0.1 | 0.5 | 0.4 | 0.0 |

| Industry PE | 59.5 | |||

| Industry PB | 7.2 | |||

Happy Investing!

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here...

Yash Vora is a financial writer with the Microcap Millionaires team at Equitymaster. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.

Equitymaster requests your view! Post a comment on "This Undiscovered Smallcap Stock is Set to Benefit from the Ram Mandir Opening". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!